HyperQuant - Platform For Automatic Investment

Hello everyone, in this new post I will introduce you about the project HYPERQUANT, and for more details, let's just follow the following discussion:

what is HyperQuant?

HyperQuant Blockchain is a platform for automatic investment. With HyperQuant. For investors, large investors, and capital managers. HyperQuant is a platform that functions to produce highly effective financial services. This platform provides new opportunities for device and trade developers by providing functions supported by technology and management. HyperQuant applies the smart contract realization method. The HyperQuant system provides solutions for manufacturing and developing trading solutions. AI's role ranking system and intelligence that allows to manage various platform platforms. The HyperQuant application contains services and solutions for retail and corporate services.

The HyperQuant ecosystem is not only for finance that is very much needed today, but also for global distribution. Advanced AI-based technology is growing rapidly and developing. This is a special HyperQuant between AI, blockchain technology, and users. This allows users to create new products and entities, such as configuring Megabot, an automated trading portfolio system. The user creates a portfolio that contains configuration parameters, bot identification numbers, and data systems needed to add new data to a balanced solution.

HOW DOES HyperQuant WORK?

The HyperQuant business model is based on an innovative approach that determines what is important and necessary for users. The concept of this business model is based on high prices, determining methods to get prices and ensuring from competitors. HyperQuant ecosystem creates an architecture that allows it to turn technology into an actual Economic Value. Services created in the HyperQuant ecosystem have great potential for growth.

HyperQuant uses trading robots to handle operations on financial markets with a set of algorithms. Trading with the help of algorithmic systems has several advantages, namely to make decisions with maximum speed and to process needs at speeds that are not available to humans, automatically message accuracy to allow entry into problems with market demand settings.

Trading robots work precisely with the algorithms that are set and used for operations. Cryptocurrency traders and ownership of tokens are susceptible to bait which causes irrational results. Trading strategies apply in any market, whatever and at any time. The algorithm is carefully typed and has no measurement that is wrong because of uncertainty, responsibility, fear, and dissatisfaction. The basis of the algorithm is in the division of strategy classes.

The trading strategy and model has several classifications, namely as follows:

- Trend Trend Strategy: The main objective of this strategy is to carry out operations with a goal to maintain in the longest period of time. Strategy strategy for the success of financial instruments. Trending based on indicators is the most popular strategy. An indicator is a function based on the values of indicators of statistical exchange, for example, the price of an official instrument. Table of contents and strategies in the strategy The preparation of indicators and comparisons are calculated between themselves and the value of the market price.

- Counter-Trend Strategy: a strategy that reaches on expectations of significant price movements and consequent positions that open in the opposite direction. The assumption is that the price will return to the average value. Different strategies for money are the highest prices.

- Pattern Pattern Recognition: The purpose of this strategy is to classify objects in various categories. Image recognition tasks in a new background that can be identified to a particular class. Protect people who use the candlestick archetype. Candlestick patterns are certain combinations of candlesticks. There are many candlestick models and assumptions about price movements that occur or appear on candlestick models. These assumptions are strategies for the introduction of technical analysis.

- Arbitration Strategy: There are various types of Arbitration strategies namely Cross-market Arbitration and Statistical Arbitration.

- Machine learning strategies: The basis for machine learning is the modeling of historical data and the use of models to estimate prices in the future. One type of machine learning is classification.

Based on the above strategy, HyperQuant made a strategy with the Si Technologies Algorithm. The strategy of the Si Technologies Algorithm from HyperQuant is as follows:

Smart order execution strategy

This strategy class is based on work with orderbooks. HyperQuant software makes it possible to make strategies according to specific tasks.

It is impossible to execute orders with the same price first, all trades will be at the desired price, but gradually prices will become less profitable. To reduce costs, clients must use the Smart Order execution strategy. Large market order execution can be divided into several steps and developing various strategies. HyperQuant platform users will be able to configure various specific fields of quotation strategy, namely Instrument, Volume, Minimum Volume, Maximum Volume, Maximum BBO Distance, Internal quotation rate, internal quotation rate, Hedging, Hedging type and Hedging settings.

Market Making Algorithm

Explexive Algorithm. This also results in lower volatility of trading instruments. Credit is very important for the development of the trade industry. Liquidity is widespread on the giant stock market NYSE, NASDAQ, and CME. Market makers must support the two directions below and impose minimum rates and volumes of all buy and sell orders according to market makers' data.

Risk Management

Management is a function used to calculate the costs needed. Every trade and investment activity creates a certain sensationality. The risk in this case is unexpected financial responsibility in an uncertain environment. Every trader uses different information such as room rates due to fluctuations in market rates. There are other risks found, namely operational, functional, selective and liquidity risks.

Hedging

Hedging can be divided into Hedge Selling and Hedge Buying. Buying a Hedgehouse compromises planning to buy the future and helps to reduce those associated with price increases. Selling a hedge in the case of a sale on the market, and implies that the seller sets a fixed price for himself.

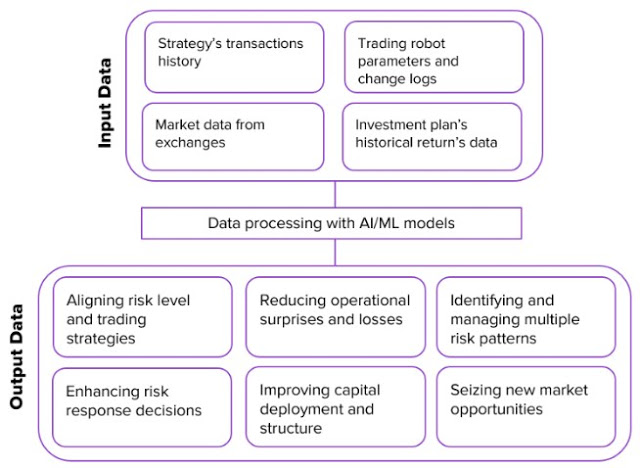

AI-based Financial Advisor

The majority of investments fail due to incorrect management and insufficient control by users. To solve this problem, HyperQuant uses intelligence based on data collected from HyperQuant platform users.

Blockchain based on Smart Contract Protocol

The HyperQuant team developed the protocol by implementing a standard for portfolio strategy, implemented as a Smart Contract.

An innovative way to effectively use AI for algorithmic purchases and sales: the HyperQuant philosophy

The use of Artificial Intelligence (AI) to trade on cryptocurrency exchange is a practice today that has spread rapidly throughout the world. However, allow it to try to investigate various platforms that are useful for valuable AI trading.

Technology development that enhances AI becomes more common in everyday lifestyles. Artificial neural networks are the premise of the AI algorithm. The teaching of introducing the neural community, that is, every operation built around, is quite simple. In the learning system - a neural network of family training statistical training models, made similar to organic neural networks (especially the primary nervous system). In essence they are verbal exchange structures that transfer messages to each other and have digital weight. This makes the neural network adapt to input and is able to learn. Therefore the network structure is continuous with time in real time.

The main hazards and problems with AI-based trading

Incorrect education or re-optimization. The market is a machine that is fully open with. Which stands from its members. Changes that occur affect market effects, fluctuations, volatility and possible prices. Frequently often often try to try to include INSTITUTE INSTITUTE TO include inserting enter the AI AI A skilled neural community, for example, to integrate faces on photos, does not apply to alternating trades - and vice versa. Trading information shows that 80% of the money used using the neural community - is set to zero in the first year after introduction.

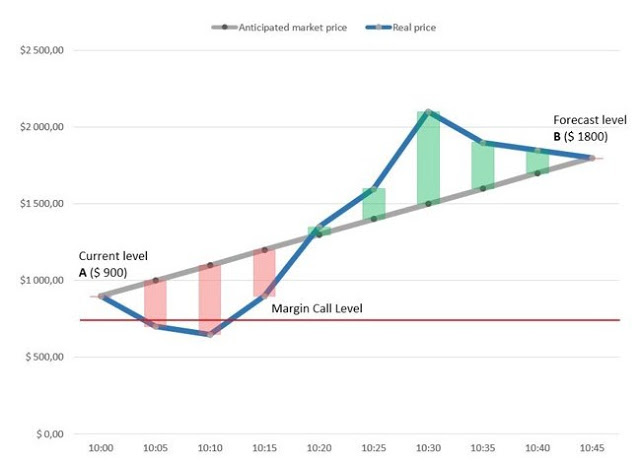

Loss or wrong opportunity management. Survive the market with the power to manipulate danger. Only financial and opportunity management allows investors to withstand unusual turbulence intervals. AI, is able to forecast the market with 90% accuracy, can make up to 10 minutes of collection. Even with the help of direction of degrees of burden and future (vital indicators are the level of tariffs, not prices) - it is impossible to determine precisely the cost (point B).

Black box. Few understand that using neural networks - an intellectual gets a black box. Complete products are closed production with a set of rules making choices that cannot be understood even for traders. With a large environment and investment - the dealer will not be able to find the exact cause.

HyperQuant philosophy.

Quantitative hedge finance is very similar to personal golf equipment, which requires a high monetary stage to enter. There is a big cause of exclusivity. Contrary to the normal budget - the quant continues to try to achieve market neutrality with a portfolio of approaches, thereby reducing the effects of market movement dynamics. This allows investors now not to worry about black swans and the risk of long-term investment.

Our philosophy is formed around the departure from market risk by cultivating the right form of threat control, balancing techniques and using extensive diversification. That is why HyperQuant uses AI no longer just to predict the market but to make first-class investment alternatives in the overall type. The central part of our platform is the neural community - a continuous learning score mechanism. Relentless development comes with the growth of the platform and the boom in the latter factors ending in the growth of statistics obtained through the neural community. This, in turn, makes the neural network retrain extra green. It is also possible to quickly adjust new elements introduced in the system.

How this works.

Complex score engines are the right way to improve financial platforms. Ranking is the potential of instruments in positive time periods that rely on a mix of quantitative and qualitative traits, which are stated in the last digital sign. Ratings can be calculated with the help of different statistical techniques. In the economic machinery sector, the ranking consists of independent rating business - Moody's, Standard and Poor's, in addition to Fitch Ratings. They are used to compare the solvency of credit scores from business firms. By using a score like that, the ability of the investor to recognize whether he can buy corporate responsibility and a reliable way of investing.

AI forms the values of motion primarily based on its own analysis engine. This can be proven to the user by using understandable images. Investment separation uses a variety of standards, simple strategies, opportunities and profitability.

HyperQuant offers an interface to receive and integrate facts collected from all cryptocurrency exchanges.

In addition, the request switch protocol, which was developed with the help of HyperQuant (the HQ-FOT protocol - a partner of the FIX / FAST protocol), makes it possible to accelerate the transfer of orders in the trading structure up to 10 times.

The HyperQuant platform automatically balances and enters order data in exchange for crypto for this reason to stabilize them.

The strategy used to increase alternative positions repeatedly without unexpected costs.

With this operation, the HyperQuant platform offers a major burden, allowing different AIs to use the best features - shifting indicators that are beneficial to these people.

The latest AI-based technology is truly developing and developing today. This will be the next "Big Thing", a new trillion dollar company. But here at HyperQuant we don't only develop a few different or better ones, we're building a large platform

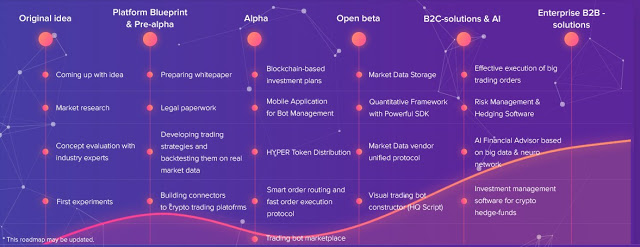

ROADMAP

For more information and joining HyperQuant social media today please follow the following resources:

Website: https://goo.gl/wGkw41

Whitepaper: https://hyperquant.net/en/wp/

Onepager: https://hyperquant.net/en/op/

Facebook: https://www.facebook.com/hyperquant.net/

Twitter: https://twitter.com/hyperquant_net

Sedang: https://medium.com/hyperquant

User Name: Vinarianty05

Profile: https://bitcointalk.org/index.php?action=profile;u=1548200

ETH: 0xB036f6Fa07346e1Dd7E75B38683C7905d57524f0

Komentar

Posting Komentar